THE PENSION RESERVE

- Home

- THE PENSION RESERVE

About the Pension Reserve Fund (THE PENSION RESERVE)

What is the Pension Reserve Fund (THE PENSION RESERVE)?

The Pension Reserve Fund is a savings account or fund that will receive contributions from the Government of Puerto Rico over the next 10 years, starting in 2022, to ensure pension payments to retirees and active employees who are entitled to a defined benefits pension from the Government, Teachers, and Judiciary retirement systems when the government lacks sufficient funds to make such payments. THE PENSION RESERVE does not replace the Retirement System, nor does it release the Government from its pension payment obligations.

THE PENSION RESERVE and its Governing Guidelines are part of the Puerto Rico Plan of Adjustment confirmed by the Federal Court, which means that if the Government of P.R. fails to make the deposits required by the Regulation or violates any of the requirements, parties may seek compliance in the U.S. District Court for the District of P.R.

- Supports pension payments.

- Is part of the Plan of Adjustment for the Commonwealth of Puerto Rico.

- Is an entity independent from the Government of Puerto Rico.

- Benefits Government retirees and active employees who are entitled to receive defined pension benefits.

How did THE PENSION RESERVE emerge?

THE PENSION RESERVE is a mechanism created to ensure that there is money set aside to help the Government make pension payments when cash flow is poor, as it happened in 2017, when the Government of P.R. filed for bankruptcy under Title III of the PROMESA Act in order to restructure its debt, including its obligations with the Employee Retirement System, the Teachers Retirement System, and the Retirement System for the Judiciary. At the time, the retirement systems were running out of funds and the pensions of nearly 167,000 retirees were at risk of facing cuts of up to 25%, mainly because the Government of P.R. had for decades failed to make the necessary contributions that would allow the retirement systems to make their pension payments.

To protect their pension benefits, a group of 17 retiree organizations called for the creation of an official committee that would represent their interests in the government bankruptcy case before the U.S. District Court for the District of P.R. This was the beginning of the Official Committee of Retired Employees, which in 2008, while in negotiations with the Financial Oversight and Management Board for Puerto Rico (FOMB), proposed the creation of THE PENSION RESERVE as a mechanism for protecting pensions in the short and long term. The FOMB, the Government of P.R., and Servidores Públicos Unidos/AFSCME supported this mechanism to provide stability and confidence to retirees.

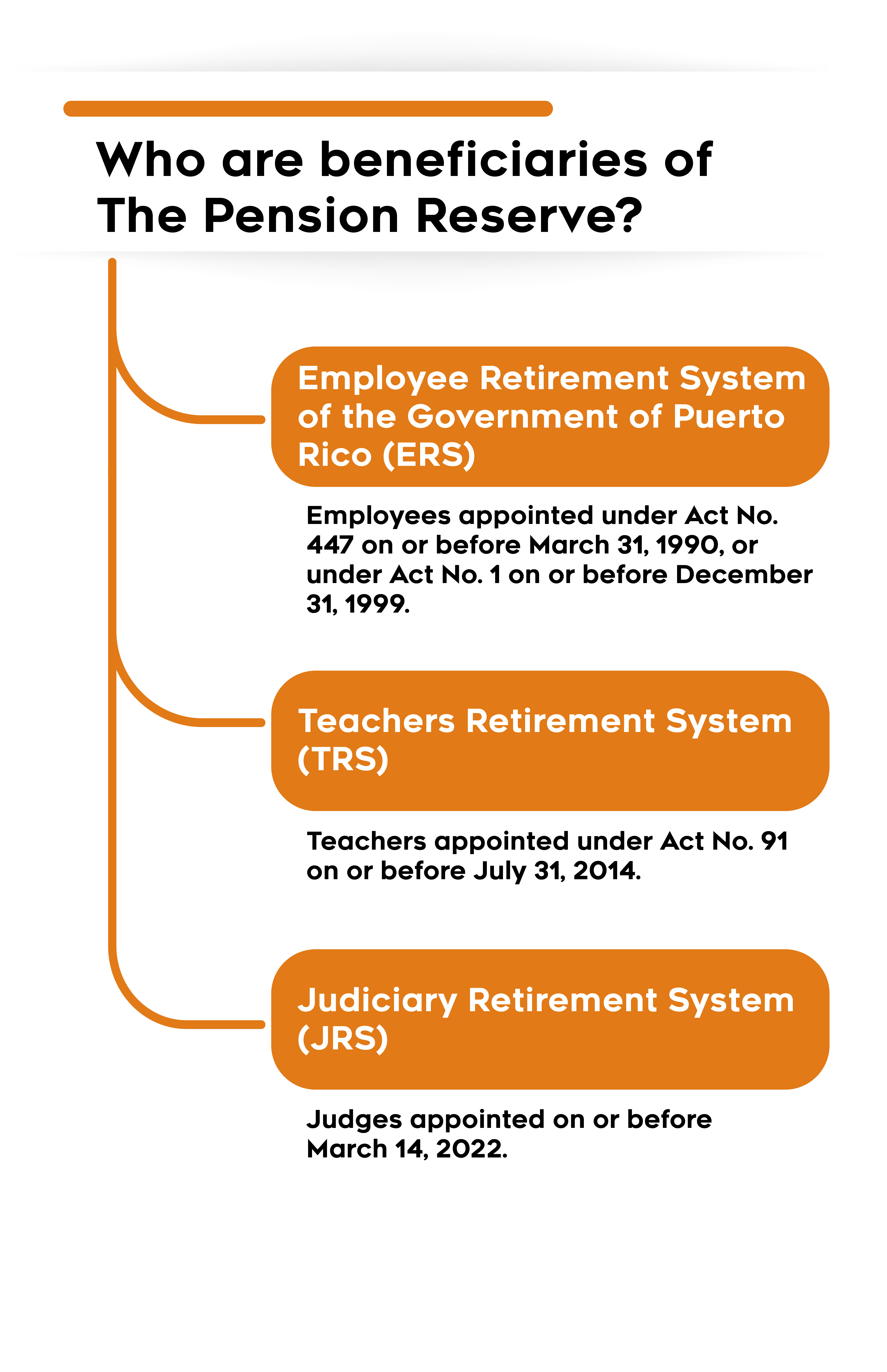

Who are beneficiaries of THE PENSION RESERVE?

Retirees and active employees who are entitled to a defined benefits pension from the Government, Teachers, and Judiciary retirement systems will benefit from THE PENSION RESERVE to support pension payments.

Who are not beneficiaries of the PENSION RESERVE?

- Government Employee Retirement System: Act No. 305 of September 24, 1999 (2000 Reform) / Act No. 3-2013; Act No. 106-2017 (Defined Contributions). Appointed as of December 1, 2000, onwards.

- Teachers: Act No. 160-2013 / Act No. 106-2017 (Defined Contributions). Appointed from August 1, 2014, onwards.

- Judges: Appointed as of March 15, 2022.

Pensionados que no han pasado a la nómina del Sistema PayGo: Si es participante de la Ley 70 del 2 de julio de 2010, de la Ley 211 del 8 de diciembre de 2015 o cualquier otra legislación existente o futura que incentive el retiro, en donde: (a) los exempleados todavía estén cobrando su beneficio de retiro de la nómina de su patrono y (b) todavía no hayan pasado a la nómina del Sistema PayGo, no participan del Fondo de la Reserva de Pensiones. Una vez pase a la nómina del Sistema PayGo, podrá votar y nominarse al Consejo de Beneficios de Pensiones.

How does THE PENSION RESERVE work?

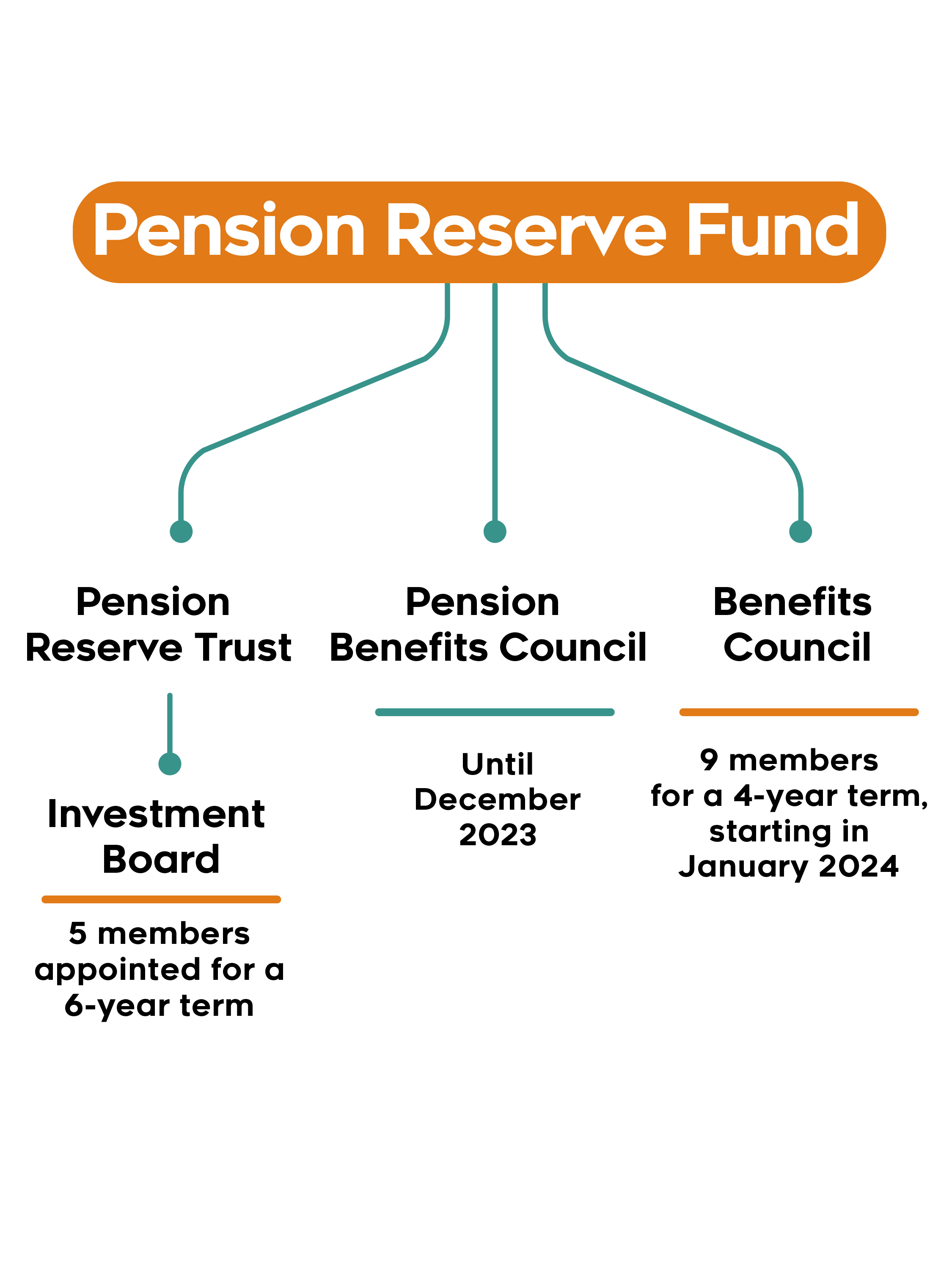

THE PENSION RESERVE is independent from the Government of Puerto Rico and consists of two separate entities with different functions:

The Pension Benefits Council –

Está mayormente compuesto por retirados electos, para velar que el Gobierno de Puerto Rico cumpla con los requisitos de los depósitos anuales y las condiciones para retirar fondos de THE PENSION RESERVE para pagar pensiones conforme a las Guías.

The Investment Board –

Está compuesta por un grupo de cinco síndicos con experiencia en inversiones y pensiones nombrados por un términos de 6 años, para invertir y manejar los fondos. Los síndicos son nombrados de la siguiente manera: el Consejo de Beneficios nombra a 2, el Gobernador de Puerto Rico nombra a 2 y la Junta de Supervisión Fiscal (JSF) nombra a 1. Cuando la JSF deje de existir, entonces el Consejo nombrará a tres (3) síndicos.

The Guidelines further provide for the creation of a Transitional Pension Benefits Council (Transitional Council) to elect the six (6) individuals who will represent the retirees and active employees in the first Benefits Council for a 4-year period.

Have questions?

Share your questions regarding THE PENSION RESERVE with the Transitional Council, so that we can help you in any way possible.